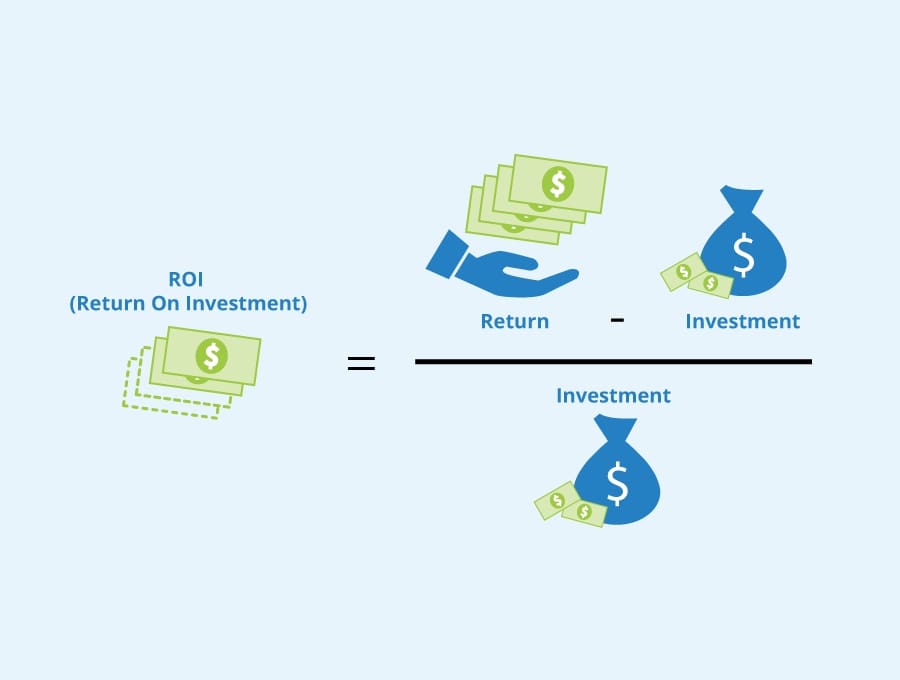

The formula for determining roi is

Return On Invested Capital - ROIC. Amount returned amount invested x 100 ROI.

Calculating Return On Investment Roi In Excel

Excess returns may be reinvested thus securing future.

. CAP rate 10000 100000 10. Customer Lifetime Value Customer Value Average Customer Lifespan where Customer Value Average Purchase Value Average Number of Purchases. Even so you should drill further down into these metrics to determine their impact on your revenues.

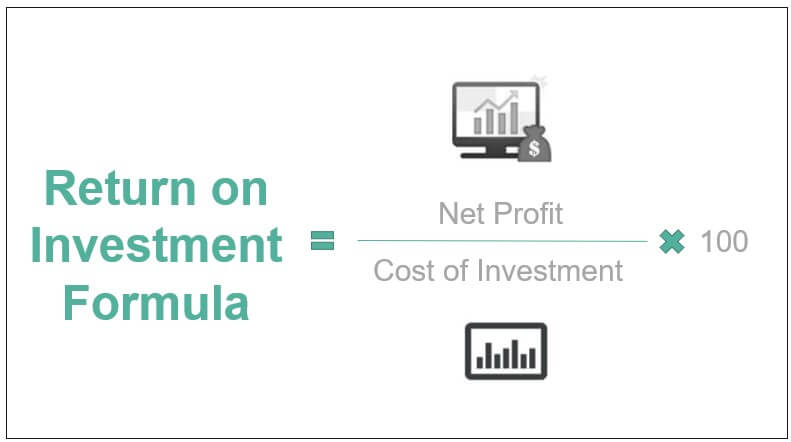

Gross profit - additional expenses. Return on investment ROI measures how effectively a business uses its capital to generate profit. ROI Financial value Project cost Project cost x 100.

The basic formula of the ROI is a division of expected constant returns by the investment amount. There are two models that companies will use to measure customer lifetime value. In any case this method is an effective way to measure the success of your training program.

Formula for ROI Calculation. For education surveys we recommend getting a statistically significant sample size that represents the populationIf youre planning on making changes in your school based on feedback from students about the institution instructors teachers etc a statistically significant sample size will help you get results to lead your school to success. However determining ROI can be a bit more complex than a simple math equation.

Well look at both components of this formula and how to calculate them below. To do this marketers should add the following to their marketing ROI formula. CAP Rate Formula.

When making these decisions small businesses might conduct. Net Profit Ratio Net profitRevenue from Operations 100. Holding period return is the total return received from holding an asset or portfolio of assets over a period of time generally expressed as a percentage.

A company can evaluate its growth by looking at its return on invested capital ratio. Customer Lifetime Value Model. Others consider ROI its own level and make it the 5th level of evaluation.

Net Profit Startup Costs Operational Costs x 100 ROI. Net Profit Ratio Net Profit after tax Net sales. As a basic example lets say that you have the following values for a small food stand.

It is usually calculated for only one period. ROI Investment value - Investment cost Investment cost. Return on invested capital gives a.

Plugging in the ROI formula can give you a perfect snapshot of your marketing results. For example lets say the building has a sale price of 100000 and after all expenses including insurance hydro and utilities the profit is 10000. The formula for determining ROI is.

As mentioned before the formula for ROI calculation is as follows. Determining the purpose of the analysis relates to the expected result type. Holding Period ReturnYield.

Total revenue - cost of goods to deliver a product. Any firm earning excess returns on investments totaling more than the cost of acquiring the capital is a value creator and therefore usually trades at a premium. Determining ROI on lead acquisition is critical as the goal is to keep Cost Per Lead CPL in line with your companys revenue goals.

You can solve the formula for portfolio returns with simple addition but only after determining a few things about each asset type. This is a pretty straightforward formula that can be applied to practically any business department no matter if its HR or marketing. If you made 20 sales in a month and you had 2000 unique visitors to your site your conversion rate would be 1.

A calculation used to assess a companys efficiency at allocating the capital under its control to profitable investments. If youre tracking conversions from website leads your formula looks like so. ROI.

The higher the ROI the better. Conversion Rate Total Number of Sales Number of Unique Visitors 100 Example. It helps investors in determining whether the companys management is able to generate profit from the sales and how well the operating costs and costs related to overhead are contained.

Determining your profitability on tangible costs is one thing but applying the same methodology when it comes to intangible expenses like advertising and marketing can be quite another. CAP rate calculation Buildings Profit BI Buildings Purchase Price. It clarifies whether solely economic aspects are to be considered or whether qualitative criteria are also relevant and.

Formula for net profit ratio is. The CAP rate will be calculated as. By determining your core metrics and measuring their effectiveness itll help you change areas of your marketing campaign to increase your conversions and.

Diving deeper marketers can calculate the impact of their marketing efforts toward net profit by adding the following to their formula. ROI Net Profit Cost of Investment x 100. When trying to quantify the value piece of the ROI formula remember the acronym TVD.

I recommend starting this process in a spreadsheet to organize the asset types and simplify the required math. In the restaurant industry this translates to. Determining the Value of a Company.

The last step is to take the two numbers youve determined and apply them to this formula. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. Acquiring leads can get expensive if your marketing strategy isnt up to par.

Small businesses often calculate ROI percentages when determining whether to invest in new equipment technology or inventory. Some training professionals consider ROI analysis to be one method for determining the results of Kirkpatricks fourth level of evaluation. If a practitioner can define the present Time Volume and Dollars needed to complete the process the projects value can be derived.

Tap enter or return on your keyboard to calculate your ROI. Here are two ways to represent this formula. For marketing ROI you can focus on core metrics that are from the above formula.

If the formula doesnt automatically calculate it as a percentage. ROI is an understandable and easily calculated metric for determining the efficiency of an. Financial gains after software purchase cost of software cost of software.

So your ROI formula may look something like. Essentially investors will need to calculate the weight and return of each asset in their portfolios.

How To Measure The Roi Of Your Content Marketing Foleon

What Is Roi And How Is It Calculated Incentive Solutions

How To Calculate Roi For Seo Mention

A 5 Step Formula For Sending Highly Personalized Sales Emails At Scale Sample Resume Sales Development Resume

Return On Investment Definition Formula Roi Calculation

Calculating Return On Investment Roi In Excel

Return On Investment Roi Definition Equation How To Calculate It

5 Easy Ways To Measure The Roi Of Training

Return On Investment Roi Formula And Excel Calculator

7 Ways To Show Marketing Roi To Your Clients

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Sales Roi Calculator Analyze Your Investments Badger Maps

Marketing Roi Definition And How To Calculate It Ruler Analytics

Return On Investment Roi Roi Accounting Investing Return On Assets Economy Lessons

Return On Investment Roi Definition Equation How To Calculate It

How To Calculate The Value Of Your Social Media Followers Calculator Social Media Metrics Social Media Followers Social Media Resources

Roi Calculator How To Calculate Marketing Roi